Point of Sale (POS)

Introduction to the point of Sale (POS)

Point of Sale (POS) is system retailers and other businesses use to process transactions and manage sales. It is the point where the customer makes a payment for goods or services, and the company records the sale. The POS system typically includes hardware components, such as a terminal, barcode scanner, and cash drawer, and software components allowing for transaction processing, inventory management, and reporting.

The Purpose of Point of Sale (POS)

The primary purpose of a Point of Sale system is to streamline the process of conducting sales transactioBusinessessses can reduce transaction times, increase efficiency, and provide better customer expertise by automating the sales processing. The POS system allows businesses to track inventory levels, monitor sales data, and manage employee activities. It also enables businesses to accept multiple payment methods, including credit cards, debit cards, and mobile payments.

Brief History of Point of Sale (POS)

The first Point of Sale system was introduced in the early 1970s. The plan was developed by IBM and used magnetic stripe technology to read credit cards. Since then, POS systems have evolved significantly, incorporating new technologies such as touch screens, mobile devices, and cloud computing. Modern POS systems have become essential for businesses of all sizes, from small retailers to large corporations.

Components of Point of Sale (POS)

Retailers and other businesses use point of Sale (POS) systems to process transactions, manage inventory, and generate sales reports. A typical POS system consists of several hardware and software components that work together to provide a seamless transaction experience for the customer and the business owner.

Hardware Components

The hardware components of a POS system include the following:

- POS terminal: This is the system’s central component and is used to enter transaction information, process payments, and manage sales data. Modern POS terminals often feature touch screens and can be customized with various peripheral devices.

- Barcode scanner: A barcode scanner is used to scan the barcodes of products being sold. This allows for quick and accurate recording of transaction information and inventory management.

- Cash drawer: A cash drawer stores cash and coins received from customers during transactions. It is typically locked and can only be accessed by authorized personnel.

- Receipt printer: A receipt printer is used to print receipts for customers. Modern receipt printers can print tickets quickly and include features such as automatic paper cutting.

Software Components

The software components of a POS system include the following:

- Operating system: The operating system is the foundation of the POS system and manages the hardware components. Popular operating systems used in POS systems include Windows, iOS, and Android.

- POS software: The POS software manages sales data, processes transactions, and generates reports. It allows businesses to track inventory levels, monitor sales trends, and manage employee activities.

- Payment processing software: Payment processing software is used to process customer payments. It interfaces with credit card processing systems and allows businesses to accept multiple forms of payment, including credit cards, debit cards, and mobile payments.

- Inventory management software: Inventory management software tracks inventory levels and manages stock. It allows businesses to monitor product levels in real-time, set reorder points, and generate reports.

Benefits of a POS System

There are many benefits to using a POS system, including the following:

- Improved transaction processing: POS systems allow for quick and accurate processing of transactions, reducing transaction times and increasing efficiency.

- Enhanced customer experience: With a POS system, customers can enjoy faster and more efficient transactions, and businesses can offer multiple payment options and provide accurate pricing information.

- Better inventory management: A POS system allows businesses to track inventory levels, monitor product trends, and manage stock. This helps companies to avoid stockouts and overstocking, reducing waste and improving profitability.

- Accurate sales reporting: POS systems provide businesses with actual sales data, enabling them to make informed decisions about pricing, promotions, and inventory management.

Choosing a POS System

When choosing a POS system, there are several factors to consider, including the following:

- Business needs: Different companies have different needs regarding a POS system. Consider your business size, type, and industry when choosing a plan.

- Features: Look for a system with the necessary parts, such as inventory management, reporting, and payment processing.

- Integration: Consider whether the POS system can integrate with your other software, such as accounting or customer relationship management (CRM).

- Ease of use: Choose a system that is easy to set up, use, and maintain. Training and support should also be available.

In conclusion, a Point of Sale (POS) system is critical for businesses of all sizes. It streamlines the transaction process, provides accurate sales data, and helps companies to manage inventory levels. When choosing a POS system, consider your business needs, system features, integration capabilities, and ease of use.

Types of Point of Sale (POS) Systems

Point of Sale (POS) systems come in various types, each with features and benefits. You are choosing the right POS system for your n business size, industry, and budget. This article will explore the different types of POS systems available.

Traditional POS Systems

Traditional POS systems are the most common POS system and have been used for decades. They consist of a terminal connected to peripheral devices such as a cash drawer, barcode scanner, and receipt printer. Traditional POS systems require an internet connection to process credit card transactions and store data.

Benefits of traditional POS systems:

- Established technology: Traditional POS systems have been used for decades and are a tried-and-true technology.

- Reliable: Traditional POS systems are known for their reliability, with few technical issues or downtime.

- Versatile: Traditional POS systems can be used in various industries and businesses.

- Secure: Traditional POS systems have built-in security features to protect sensitive customer data.

Cloud-Based POS Systems

Cloud-based POS systems, also known as web-based or software as a service (SaaS), are becoming increasingly popular. They operate on a subscription model, storing data on remote servers. Cloud-based POS systems require an internet connection to function and can be accessed from anywhere with an internet connection.

Benefits of cloud-based POS systems:

- Flexibility: Cloud-based POS systems can be accessed from anywhere with an internet connection, making them ideal for businesses with multiple locations or needing to access sales data remotely.

- Scalability: Cloud-based POS systems can quickly scale up or down depending on business needs.

- Easy to update: Cloud-based POS systems are updated automatically, so businesses can always access the latest features and security updates.

- Cost-effective: Cloud-based POS systems have lower upfront costs than traditional POS systems, as hardware is not needed.

Mobile POS Systems

Mobile POS systems use a smartphone or tablet as the POS terminal. They are ideal for businesses that operate on the go or those with limited space. Mobile POS systems can be used with peripheral devices such as card readers and printers to process transactions.

Benefits of mobile POS systems:

- Portability: Mobile POS systems can be used anywhere, making them ideal for businesses that operate on the go.

- Affordability: Mobile POS systems have lower upfront costs than traditional POS systems, as purchasing a dedicated terminal is unnecessary.

- Flexibility: Mobile POS systems can be used with various peripheral devices, making them versatile.

- User-friendly: Mobile POS systems with intuitive interfaces are easy to set up and use.

4. Self-Service Kiosk POS Systems

Self-service kiosk POS systems are becoming increasingly popular, especially in the fast-food industry. Customers can place and pay for their orders at a self-service kiosk, reducing wait times and increasing efficiency.

Benefits of self-service kiosk POS systems:

- Increased efficiency: Self-service kiosks reduce wait times and improve order accuracy, increasing customer satisfaction.

- Reduced labor costs: Self-service kiosks can reduce labor costs, as fewer employees are needed to take orders.

- Versatility: Self-service kiosks can be used in various industries, including retail, hospitality, and healthcare.

- Increased sales: Self-service kiosks can encourage customers to place larger orders by upselling or suggesting complementary items.

Choosing the Right POS System

Choosing the right POS system depends on business size, industry, budget, and specific needs. Consider the features and benefits of each type of POS system and select the one that best meets your business needs.

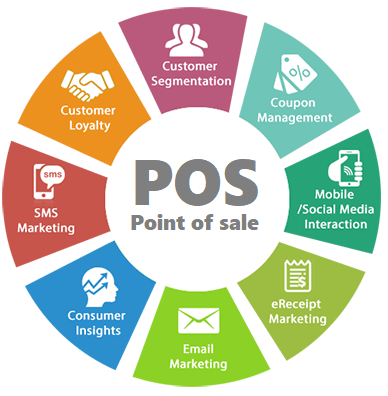

Benefits of Point of Sale (POS)

Point of Sale (POS) systems offer a range of benefits to businesses of all sizes and industries. By streamlining operations, improving customer experience, and providing real-time data insights, POS systems can help companies to save time and money, increase revenue, and enhance overall efficiency. This article will explore the benefits of using a POS system for your business.

Streamlining Operations

POS systems can streamline operations by automating manual tasks such as inventory management, order processing, and reporting. With automated processes, businesses can save time and reduce errors, allowing employees to focus on other tasks, such as providing exceptional customer service.

Benefits of streamlining operations:

- Increased efficiency: By automating manual tasks, businesses can improve efficiency, reducing customer wait times and increasing employee productivity.

- Improved accuracy: POS systems can reduce the risk of errors in inventory management, order processing, and reporting, leading to improved accuracy and fewer mistakes.

- Reduced costs: Streamlining operations can reduce labor costs, as fewer employees are needed to complete manual tasks.

Improved Customer Experience

POS systems can improve the customer experience by providing faster, more efficient service. With features such as mobile ordering, self-service kiosks, and loyalty programs, businesses can enhance the customer experience and increase customer satisfaction.

Benefits of improved customer experience:

- Increased sales: Businesses can improve sales and revenue by providing faster and more efficient service.

- Higher customer satisfaction: Customers are likelier to return to businesses that provide an exceptional customer experience, leading to increased loyalty and repeat business.

- Enhanced brand reputation: A positive customer experience can enhance a business’s reputation and attract new customers through positive word-of-mouth.

Real-Time Data Insights

POS systems can provide businesses with real-time data insights, allowing them to make informed decisions and optimize their operations. With features such as sales reporting, inventory tracking, and customer analytics, businesses can gain valuable insights into their processes and make data-driven decisions.

Benefits of real-time data insights:

- Improved decision-making: With real-time data insights, businesses can make informed decisions and optimize their operations for maximum efficiency and profitability.

- Enhanced inventory management: Real-time inventory tracking allows businesses to track inventory levels in real time, reducing the risk of stockouts and overstocking.

- Personalized customer experiences: Businesses can provide customized experiences and targeted marketing campaigns by analyzing customer data, increasing customer loyalty and repeat business.

Increased Security

POS systems can improve security by providing secure payment processing and protecting sensitive customer data. With features such as encryption and tokenization, businesses can protect against data breaches and fraud, reducing the risk of financial loss and reputational damage.

Benefits of increased security:

- Reduced risk of fraud: POS systems provide secure payment processing, reducing the risk of fraud and chargebacks.

- Protection of sensitive customer data: POS systems protect sensitive customer data, such as credit card information, reducing the risk of data breaches and identity theft.

- Enhanced brand reputation: Businesses can enhance their reputation and build customer trust by providing secure payment processing and protecting sensitive customer data.

In conclusion, POS systems offer a range of benefits to businesses, including streamlining operations, improving the customer experience, providing real-time data insights, and increasing security. Choosing the right POS system for your business can optimize your operations, increase efficiency, and enhance profitability.

Choosing a Point of Sale (POS) System

Choosing the right Point of Sale (POS) system can be critical for any business. With so many different options on the market, it can be challenging to determine which method is the best fit for your specific needs. This article will explore the key factors to consider when choosing a POS system for your business.

Type of Business

The first factor to consider when choosing a POS system is the type of business you operate. Different companies have different needs, and POS systems are designed to meet those specific needs. For example, a restaurant would require a POS system with table management and menu customization features. In contrast, a retail store would require a POS system with inventory tracking and barcode scanning capabilities.

Key factors to consider for the type of business:

- Industry-specific features: Look for a POS system designed specifically for your industry, with features catering to your business needs.

- Scalability: Consider a POS system that can grow with your business and adapt to changing needs.

- Integration: Look for a POS system that can integrate with your business’s other software or systems.

Hardware and Software

The hardware and software of a POS system are critical components to consider when choosing a plan. The hardware includes the physical features, such as the terminals, printers, and scanners, while the software consists of the applications and programs that run on the system.

Key factors to consider for hardware and software:

- User-friendly interface: Look for a POS system with a user-friendly interface that is easy to navigate for employees.

- Compatibility: Ensure that the hardware and software are compatible with your existing systems, such as your payment processing and accounting software.

- Reliability: Choose a POS system with hardware and software that is reliable and has a low risk of downtime.

Cost

The cost of a POS system is a significant factor to consider when making a decision. POS systems can range in price, and finding a plan that fits your budget while still providing the features and capabilities you need is essential.

Key factors to consider for cost:

- Upfront costs: Consider the upfront costs of purchasing and installing a POS system, including hardware, software, and installation fees.

- Ongoing costs: Consider the ongoing costs of a POS system, including maintenance fees, transaction fees, and software updates.

- Return on investment: Look for a POS system that can provide a positive return on investment through increased efficiency, sales, and profitability.

Customer Support

Customer support is another critical factor to consider when choosing a POS system. A reliable support team can help ensure that any issues or problems with the system are quickly resolved, reducing the risk of downtime or lost sales.

Key factors to consider for customer support:

- Availability: Look for a POS system provider that offers 24/7 customer support to ensure that help is always available when you need it.

- Response time: Consider the response time of the customer support team and how quickly they can resolve issues.

- Training and resources: Look for a POS system provider offering training and resources to ensure employees are fully trained and can use the system effectively.

In conclusion, choosing the right POS system for your business can significantly impact your operations, efficiency, and profitability. By considering factors such as the type of business, hardware and software, cost, and customer support, you can make an informed decision and find a POS system that meets your needs.

Security and Compliance in Point of Sale (POS) Systems

Regarding Point of Sale (POS) systems, security, and compliance are crucial considerations. In today’s digital age, security breaches and data thefts are more common than ever before. A POS system is responsible for handling sensitive customer data, such as payment information, and ensuring that this data is kept secure and protected. This article will explore the critical aspects of security and compliance in POS systems.

Data Encryption

Data encryption is a critical aspect of security in POS systems. Encryption involves converting sensitive data into an unreadable format, making it difficult for hackers to access and steal it. Choosing a POS system that utilizes advanced encryption techniques to protect customer data is essential.

Key factors to consider for data encryption:

- Encryption methods: Look for a POS system that uses the latest encryption methods, such as SSL/TLS or AES, to protect data.

- Encryption scope: Consider the size of encryption, which includes data in transit and data at rest.

- Key management: Ensure the POS system has secure control to protect encryption keys.

Secure Transactions

Secure transactions are essential to protect customer data and prevent fraud. A secure transaction involves ensuring that payment data is transmitted safely between the customer and the merchant and that the transaction is completed without unauthorized access or interception.

Key factors to consider for secure transactions:

- Payment processing: Look for a POS system that uses secure payment processing methods, such as EMV or NFC, to protect payment data.

- Authorization: Ensure that the POS system requires approval before processing transactions, such as requiring a PIN or signature.

- Fraud detection: Look for a POS system with detection capabilities to identify and prevent fraudulent transactions.

Compliance with Regulations

Compliance with regulations is essential when it comes to POS systems. Regulatory bodies, such as the Payment Card Industry (PCI) Security Standards Council, have established guidelines and regulations for the protection of customer data. Choosing a POS system that complies with these regulations is essential to ensure that customer data is protected and that the merchant is not subject to any peies or fines.

Key factors to consider for compliance:

- PCI compliance: Look for a POS system that is PCI compliant and adheres to the latest PCI DSS standards.

- EMV compliance: Ensure that the POS system complies with EMV regulations designed to protect against payment card fraud.

- Regulatory updates: Choose a POS system that stays up-to-date with regulatory updates and ensures compliance with new guidelines and regulations.

In conclusion, the critical aspects of Point of Sale (POS) systems are security and compliance. By considering factors such as data encryption, secure transactions, and compliance with regulations, businesses can ensure that customer data is protected and that they are not subject to any penalties or fines. It is esChoosingystem with security and compliance in mind, utilize is essentially the latest encryption techniques, payment processing methods, and regulatory compliance standards.

Future of Point of Sale (POS) Systems

The Point of Sale (POS) industry constantly evolves, and advancements are made daily. As technology continues to develop, the future of POS systems looks bright. This article will explore the key trends and promotions shaping the future of POS systems.

Mobile POS

Mobile POS systems are becoming increasingly popular, allowing businesses to process transactions on the go. With a mobile POS system, companies can take payments using a smartphone or tablet, making it easy to process transactions from anywhere. This is particularly useful for small businesses or vendors who do not have a permanent physical location.

Key features of mobile POS:

- Portable and flexible: Mobile POS systems are lightweight and easy to carry, making them perfect for on-the-go transactions.

- Integration with other systems: Mobile POS systems can integrate with other business systems, such as inventory management, customer relationship management, and accounting software.

- Contactless payment: Mobile POS systems can accept contactless payment methods such as Apple Pay or Google Wallet.

Cloud-Based POS

Cloud-based POS systems are becoming increasingly popular, offering many advantages over traditional methods. A cloud-based POS system stores data on remote servers accessed from any location with an internet connection. This means businesses can manage their sales and inventory from anywhere without needing a physical server.

Critical features of cloud-based POS:

- Remote access: Cloud-based POS systems can be accessed from any location with an internet connection, making it easy to manage sales and inventory on the go.

- Scalability: Cloud-based POS systems can be easily scaled up or down as the business grows, making it a cost-effective option for businesses of all sizes.

- Data analytics: Cloud-based POS systems offer advanced data analytics tools, allowing businesses to analyze sales trends, customer behavior, and inventory management.

Artificial Intelligence (AI)

Artificial intelligence is becoming increasingly important in the POS industry, offering new capabilities and previously impossible features. AI can analyze customer behavior, personalize promotions and discounts, and optimize inventory management.

Critical features of AI in POS:

- Personalization: AI can analyze customer behavior and preferences, allowing businesses to offer personalized promotions and discounts.

- Inventory management: AI can be used to optimize inventory management, analyzing sales data to predict demand and order products automatically.

- Fraud detection: AI can detect and prevent fraud, identifying suspicious behavior and transaction patterns.

Integration with other systems

Integration with other systems is becoming increasingly important in the POS industry. Businesses can streamline their operations and reduce manual data entry by integrating with other business systems, such as inventory management, customer relationship management, and accounting software.

Critical features of integration:

- Streamlined operations: Integration with other systems can streamline processes, reducing manual data entry and improving efficiency.

- Improved accuracy: Integration can improve data accuracy, reducing errors and minimizing the risk of fraud.

- Comprehensive reporting: Integration can provide comprehensive reporting and analytics, allowing businesses to make informed decisions based on real-time data.

In conclusion, the future of Point of Sale (POS) systems is bright, with new advancements and capabilities emerging daily. Mobile POS, cloud-based POS, artificial intelligence, and integration with other systems are all key trends shaping the future of POS. By embracing these advancements, businesses can streamline their operations, improve efficiency, and stay ahead of the competition.

Conclusion

In conclusion, Point of Sale (POS) systems have revolutionized how businesses operate. From small retailers to large enterprises, POS systems have become essential for processing transactions, managing inventory, and analyzing sales data. With the continued advancements in technology, POS systems are becoming increasingly sophisticated, offering new capabilities and previously impossible features.

The benefits of POS systems include improved efficiency, reduced costs, and enhanced customer experience. With a POS system, businesses can process transactions quickly and accurately, reducing the risk of errors and fraud. They can also manage real-time inventory, ensuring they always have the products that customers want.

When choosing a POS system, businesses must consider several factors, including the type of system, its features, and its security and compliance. They should also ensure the system is easy to use and can be integrated with other business systems, such as inventory management and accounting software.

As the POS industry evolves, businesses must stay updated with the latest trends and advancements. Mobile POS, cloud-based POS, artificial intelligence, and integration with other systems are all key trends shaping the future of POS. By embracing these advancements, businesses can streamline their operations, improve efficiency, and stay ahead of the competition.

In conclusion, POS systems are an essential tool for businesses of all sizes, offering a range of benefits and capabilities. By choosing the right POS system and embracing the latest advancements, companies can stay ahead of the curve and thrive in today’s competitive marketplace.

F.A.Q

How do I choose a POS system?

Choosing the right point of sale (POS) system can be daunting, as many options are available in the market. However, by following these key steps, you can make an informed decision and choose a POS system that meets the unique needs of your business:

- Define your business requirements: Determine what features and functionalities you need in a POS system based on the nature and size of your business.

- Set a budget: POS systems can range from affordable to expensive, so it’s essential to determine your budget and look for options that fit within it.

- Research different types of POS systems: There are various types of POS systems available, such as cloud-based, mobile, and traditional, each with its advantages and disadvantages. Research and compare different options to determine which fits your business needs best.

- Read reviews and testimonials: Read reviews and testimonials from other business owners who have used the POS systems you’re considering. This will give you an idea of their experiences and help you make an informed decision.

- Evaluate customer support and training: Ensure that the POS system provider offers good customer support and training, as you’ll need assistance setting up and using the system.

- Check for integrations: If your business uses other systems, such as accounting software or inventory management tools, ensure the POS system you choose can integrate.

By following these steps, you can choose a POS system that is cost-effective, user-friendly, and meets the unique requirements of your business.

What is an example of a point of sale?

An example of a point of sale (POS) system is the Square POS, a popular option for small businesses. The Square POS system consists of a mobile card reader that attaches to a smartphone or tablet and software that can be downloaded to process transactions, manage inventory, and generate sales reports. The system also offers additional features, such as creating customer profiles, setting up loyalty programs, and managing employee access. Another example of a POS system is the Clover POS, a more sophisticated system used by larger businesses and offers advanced features such as barcode scanning, custom orders, and integration with third-party applications.

What should a sound POS system do?

A good point of sale (POS) system should provide various features and functionalities that help streamline and optimize business operations. Here are some key things that a sound POS system should do:

- Process transactions: A sound POS system should be able to quickly and securely process transactions, including cash, credit card, and mobile payments.

- Manage inventory: The system should be able to manage inventory levels, track sales trends, and provide real-time inventory updates.

- Generate reports: The POS system should be able to generate reports on sales, inventory, employee performance, and other key metrics to help business owners make informed decisions.

- Provide customer management: The system should offer features such as customer profiles, loyalty programs, and targeted marketing to help businesses build customer relationships and improve retention.

- Offer employee management: The system should have features to manage employee access, set schedules, track time and attendance, and generate reports on employee performance.

- Support integration: The POS system should be able to integrate with other business applications, such as accounting software, inventory management tools, and customer relationship management (CRM) systems.

A sound POS system should be user-friendly, secure, and reliable and provide the necessary features and functionalities to help businesses operate more efficiently and effectively.